Lakeview. We discover what's in the council contract that the CEO wanted kept secret

The devil, as always, is in the detail.

Analysis.

This investigation, funded by Crux paid subscribers, examines how a $2 billion Australian luxury property development in the centre of Queenstown started life as a “risk free investment” by the Queenstown Lakes District Council. In ten parts we will tell the story of how a large piece of ratepayer owned prime real estate, valued at $42 million in 2017, was turned into a black hole that so far has cost ratepayers over $100 million, increased rates and may not get built. Crux also acknowledges the role of Google’s Pinpoint investigative journalism tools and will publish, in the public interest, each part without a paywall three days after paid subscribers receive this content.

No matter how hard we have tried, it has not been possible to get a copy of the Development Agreement between the Queenstown Lakes District Council and the Australian developers of the Lakeview project.

The same old excuses get trotted out - commercial confidentiality, privacy etc etc.

But, as is often the case, QLDC Councillor Niki Gladding has been ahead of the game with some complex and carefully constructed Official Information requests.

Now, using Google’s Pinpoint investigative journalism tool, we’ve been able to upload hundreds of pages of the Development Agreement revealed under the Official Information Act, or at least major parts of it, into the AI section of Pinpoint - Gemini.

This has allowed us to ask the questions that the community has been waiting many years to get answers to.

What’s the secret deal between our council and the developers"?

This is how we framed the question to Pinpoint after uploading ten key documents connected with the Australian request for permission from the New Zealand Overseas Investment Office to go ahead with the Queenstown Lakeview project.

Crux Q 1. What are the key contractual points between the QLDC and the developers?

“The QLDC agreement with the developer, Ninety Four Feet, includes a requirement for the developer to obtain necessary consents to start and finish construction of stages 1 and 2 of the development. The agreement also stipulates that the developer must introduce at least a certain amount of additional investment to complete stages 1 and 2, and build a specified number of residential dwellings in those stages. The agreement includes a 20-month sunset date for the first payment, beginning when QLDC completes its work. Construction funding must be in place before Ninety Four Feet settles on the land, requiring building consents and fixed-price contracts. The agreement also includes profit sharing.”

Source: Google Pinpoint analysis of Overseas Investment Office documents releasdd under the Official Information Act.

Crux Q 2. How much are the stage payments from 94 Feet to QLDC?

“The Development Agreement between QLDC and 94 Feet stipulates that 94 Feet will progressively pay QLDC $75,000,000 plus GST (if any) for the Super Lots. The purchase price payable for each stage of development is detailed in Schedule 7 of the Development Agreement. A later report indicates that the forecast net surplus for the Lakeview transaction is approximately $27 million after accounting for additional costs.”

Source: Google Pinpoint analysis of Overseas Investment Office documents released under the Official Information Act.

This analysis of the documents is crucial as QLDC has spent at least $77 million so far on preparing the Lakeview site for 94 Feet. The original budget was only around $19 million. The land was valued at $42 million in 2017 when the deal was first being assembled.

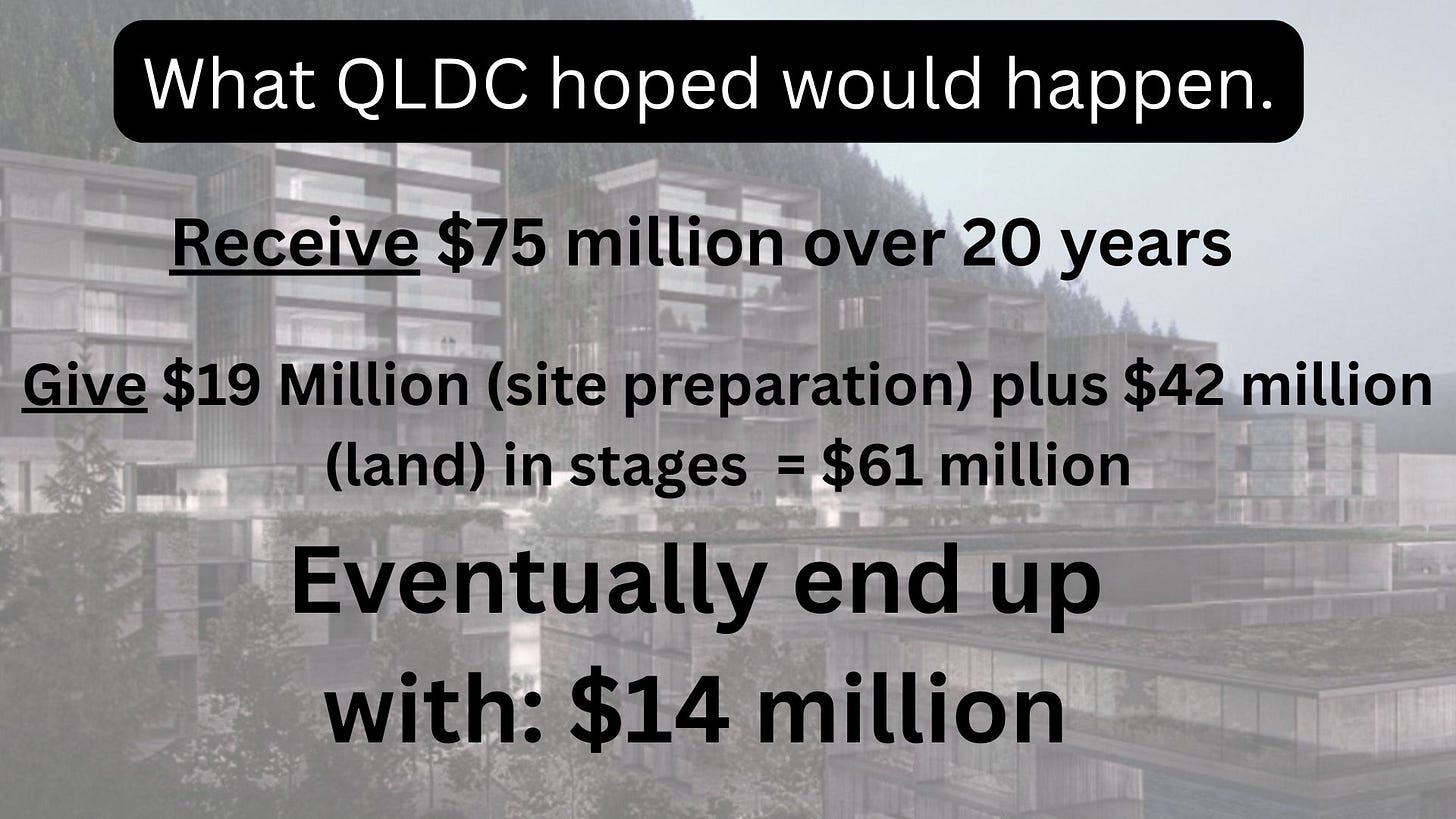

So this is what the QLDC hoped would happen.

$75 million over 20 years from 94 Feet.

$19 million to prepare the land.

$42 million land value (2017).

The explanation for the higher surplus figure ($27 million) in the OIO documents are likely to be the mysterious shared “super profits” that have been hinted at by QLDC but never truly defined.

But surely - this is still far from a deal that makes any commercial sense? The land was worth $42 million eight years ago - so why enter a deal that only returns between $14 million and $27 million over a 20 year future period?

This is what we asked of Pinpoint.

Crux Q3. How much are the super profits?

“The provided text mentions that QLDC will share in a percentage of all Super Profit (profits over and above the bid hurdle rate of %), estimated to amount to $[s 9(2)(b)(ii)] over the life of the project. However, the exact amount of super profits is redacted and not disclosed.”

Source: Google Pinpoint analysis of Overseas Investment Office documents released under the Official Information Act.

OK - so we don’t know what the super profits are. But against any super profits, if they ever happen, is another $11 million transaction cost of sale referred to in QLDC reports to their Finance, Audit and Risk (AFR) Committee .

On July 8, just three days ago, this was the latest return on investment calculation presented to the AFR Committee by Lakeview project manager Paul Speedy.

For reasons we don’t understand (secret “super profit estimates”?) the income figure has been inflated to $88 million. We do understand how the capital works figure has been deflated as the QLDC reckons that some of the site works would have been done anyway for the benefit of neighbouring houses - not for Lakeview. That has always seemed a spurious argument, especially as there are many other infrastructure costs that appear to be for Lakeview but are classified as “not Lakeview”. The $128 million “road to nowhere” is a classic example of a QLDC claimed “not Lakeview” cost.

There also a strange 300 metres of new road, right next to Lakeview and built by QLDC for $15 million that we dont believe is in the council’s Lakeview cost calculation. It can’t be argued that there is any other reason for that stretch of brand new road than the yet to be started Lakeview project.

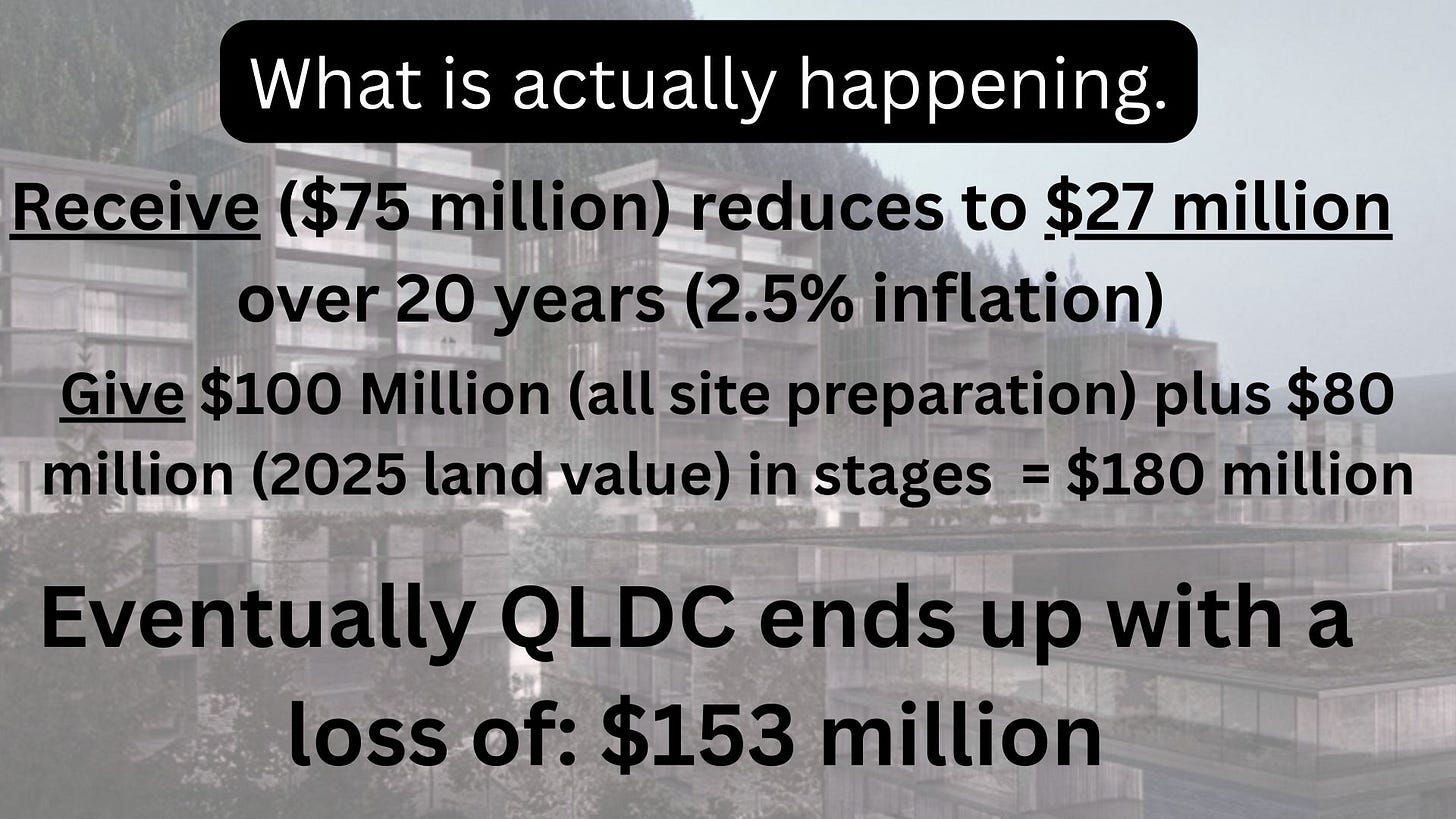

That’s why Crux has consistently uses the figure of $100 million as the Lakeview cost, so far, to ratepayers. If anything, that figure is on the conservative side.

Even if we ignore the value of the land - the above return on investment statment from QLDC actually comes out at a loss once these extra infrastructure items are taken into account.

But wait - it gets much worse.

Missing from all of the QLDC’s return on investment forecasts is the land itself. Plus the loss of value over 20 years of payments to the council.

QLDC recognises the income from selling the land, understates the cost of developing the land, ignores many ancillary works connected to Lakeview, adds an undefined share of non-existent super profits, ignores the loss of the value of money over 20 years - and ignored the current value of the land itself.

That’s around $80 million - up from $42 million over eight years ago. Queenstown land values are booming.

Before we do the final mathematics on where the QLDC actually sits financially with Lakeview. We had one last question for the OIO documents via Pinpoint.

Crux Q4. What happens if 94 Feet miss their deadlines and the project does not go ahead?

“If Ninety Four Feet miss their deadlines, standard condition 6 of the Overseas Investment Office consent will apply, and the Overseas Investment Office may require Ninety Four Feet to dispose of the land.”

Source: Google Pinpoint analysis of Overseas Investment Office documents released under the Official Information Act.

Crux published detailed coverage from a QLDC workshop in September 2024 where these “what if?” issues were discussed in some detail.

But since then the only NZ Lakeview investor, Centuria, has pulled out of the project with 94 Feet publicly stating that there are problems with “a soft housing market, bank financing and construction costs.”

At the AFR committee meeting this week, the QLDC’s Lakeview manager appeared stressed and uncertain, even though he told committee members that he still believed the project would go ahead.

QLDC’s Lakeview project manager Paul Speedy came under extreme pressure at this week’s Audit, Finance and Risk Committee meeting.

Either way, built or not, this is the current Lakeview financial position as estimated by Crux to include the missing lines of the QLDC estimates - that’s mainly the 2025 value of the land itself and the loss of value of money over a 20 year period.

Now we are not Treasury level economists or Einstein level mathematicians, and there may well be some errors in our calculations. But big picture it looks like Lakeview represents a potential loss to ratepayers of $153 million if the project goes ahead.

If the project does not get built then QLDC may be able to sell the land and recoup some losses - but the documents we have access to suggest that QLDC might need to buy the land off 94 Feet or even worse, 94 Feet could sell the land.

That gets complex as 94 Feet don’t settle with QLDC on the land title until they start construction work. So theoretically - QLDC might still be able to pull the plug.

Councillor Gladding’s View.

It’s fair to say that most if not all QLDC councillors have been relying on Mr Speedy’s optimistic Lakeview updates for the past eight years. Apart from Niki Gladding.

QLDC councillor Niki Gladding. She’s been asking tough Lakeview questions for years - but now time is running out.

Without her efforts we would not have had access to the Overseas Investment Office documents quoted in this article via Google Pinpoint.

Here’s now Councillor Gladding expressed her current Lakeview position to Crux. We started off by discussing the Crux site preparation estimate of $100 million.

“It doesn't matter whether it's a hundred million or not. I mean, at the end of the day, we've spent like 75 million on infrastructure. We're getting maybe 75 million back over 20 years. And that's not even going cover the cost of the infrastructure, let alone the fact that we had a piece of land that was worth $42 million eight years ago.”

“Is it a good contract? I mean, there's the dollar amounts that clearly have gone wrong. But I think where it has really failed is that the contract set out to achieve control.

“And yet we have had no control.”

“It should have been anticipated that we're just going to fall in line with what the developer wants because the developer knows best. The developer is going to do the most efficient thing and is looking to deliver the most profit for themselves.”

“So why didn't QLDC anticipate that? You know, did they expect us when things didn't go the way we wanted to say ‘hell no, we're not going double the height of the building”, or ‘hell no, we're not going to do A, B or C”. There's been a number of changes, but we've always, always gone along with what they wanted.

“So, you know, that's the big thing for me is that surely you should have, if you wanted control, create a contract that really does deliver you control - control to the elected councillors not the (unelected) Executive Leadership Team and the CEO. That was delegated in 2017 and we've never been able to wrestle it back.”

“QLDC wants the money, right? We need the income and we don't get the income until we settle. And so the risk for me is that the Chief Executive might, might not, but might be tempted to waive those settlement conditions, which are there to protect the ratepayer. If they're not ticked off and the i's aren't dotted and the T's aren't crossed because we just want to get the money in a hurry, then that's a problem.”

Councillor Gladding is digging hard before her term finishes with this year’s local body elections in October. Her questions have so far been kicked into touch by council managers who have filed them as LGOIMA requests - along with the attendant time delays and potential objections around confidentiality, privacy and all those other reasons not to release information.

Understandably, after years of bullying and antagonistic behaviour from some fellow councilors and senior council bosses, she’s not standing for re-election. New Zealand regional culture is not kind to people who ask persistent and difficult questions.

It’s going to be a race to the wire to see if real Lakeview answers are forthcoming or if the Lakeview nightmare gets even worse under a new council in October.

Keep digging. you are doing a very worthwhile exercise. thankyou.

"New Zealand regional culture is not kind to people who ask persistent and difficult questions"?????

Yes, those of us who have been unfortunate enough to have had to waste a decade of their lives and every cent they had to ask this same moribund, inert, monolithic, incompetent, omnipotent, omnipresent, dictatorial bastard organisation, an entity that is busying literally destroying our region simply in order to preserve its own perpetual employment ... for permission to exist, already knew that.